Press Release

Dril-Quip, Inc. Announces Second Quarter 2024 Results

Second Quarter Highlights

-

Revenue of

$120.3 million , an increase of 9.1% sequentially and 34.3% year-over-year -

Subsea Products orders booked of

$54.1 million , increasing 25% sequentially. Net of a subsea tree customer project cancellation for$39.6 million , Subsea Product Bookings were$12.8 million -

Net Loss of

$1.8 million , an improvement of$18.2 million sequentially and a decrease of$5.3 million year-over-year -

Adjusted EBITDA of

$16.5 million increased$6.3 million sequentially and$7.7 million year-over-year -

Gross Margin of 30.8% increased 194 basis points sequentially and 417 basis points year-over-year

-

Previously announced merger with

Innovex Downhole Solutions ("Innovex") remains on track to close in the third quarter of 2024

Management Commentary

"We experienced robust revenue growth and strong performance across several of our key businesses in the second quarter, particularly in our

"Our achievements this quarter are a testament to the effectiveness of our teams and strategy and set us up for further success as we work towards our transformative combination with Innovex. We look forward to the significant benefits for the combined company including scale, cross-selling opportunities, attractive synergies and diversified presence across the most compelling markets, through a transaction that is immediately accretive to all key financial measures. We expect the transaction to close in the third quarter and look forward to the significant opportunities ahead for our customers, employees and shareholders."

Operational and Financial Results

Revenue, Bookings, Cost of Sales and Gross Operating Margin

Consolidated revenue for the second quarter of 2024 was

The positive performance in the

Subsea Product orders booked in the second quarter of 2024 were

Cost of sales for the second quarter of 2024 was

Selling, General, Administrative, and Engineering & Other Expenses

Selling, general and administrative ("SG&A") expenses for the second quarter of 2024 were

Engineering and product development expenses were

Net Loss, Adjusted EBITDA and Free Cash Flow

For the second quarter of 2024, the Company reported net loss of

Adjusted EBITDA totaled

Cash used in operations was

Capital expenditures in the second quarter of 2024 were

Outlook

Due to the pending merger with Innovex, the Company has suspended providing earnings guidance updates. Accordingly, investors are cautioned not to rely on historical forward-looking statements as those forward-looking statements were the estimates of management only as of the date provided and were subject to the specific risks and uncertainties that accompanied such forward-looking statements.

Transaction Update

The transaction has been approved by the Boards of Directors of both companies. The Company expects that the merger will be completed in the third quarter of 2024, subject to customary closing conditions.

Conference Call

Due to the pending merger with Innovex,

About

Investors should note that

Forward-Looking Statements

Statements contained herein relating to future operations and financial results that are forward-looking statements, including those related to market conditions, benefits of the pending merger with Innovex, benefits of the recently completed acquisition of Great North, anticipated project bookings, anticipated timing of delivery of new orders, anticipated revenues, costs, cost synergies and savings, possible acquisitions, new product offerings and related revenues, share repurchases and expectations regarding operating results, are based upon certain assumptions and analyses made by the management of the Company in light of its experience and perception of historical trends, current conditions, expected future developments and other factors. These statements are subject to risks beyond the Company's control, including, but not limited to, risks related to the pending merger with Innovex, including uncertainty as to whether the conditions to closing the merger will be satisfied or whether the mergers will be completed, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the impact of actions taken by the

Important Information for Stockholders

In connection with the proposed merger of the Company and Innovex, the Company has filed with the

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the proposed merger. Information about the Company's directors and executive officers including a description of their interests in the Company is included in the Company's most recent Annual Report on Form 10-K/A, including any information incorporated therein by reference, as filed with the

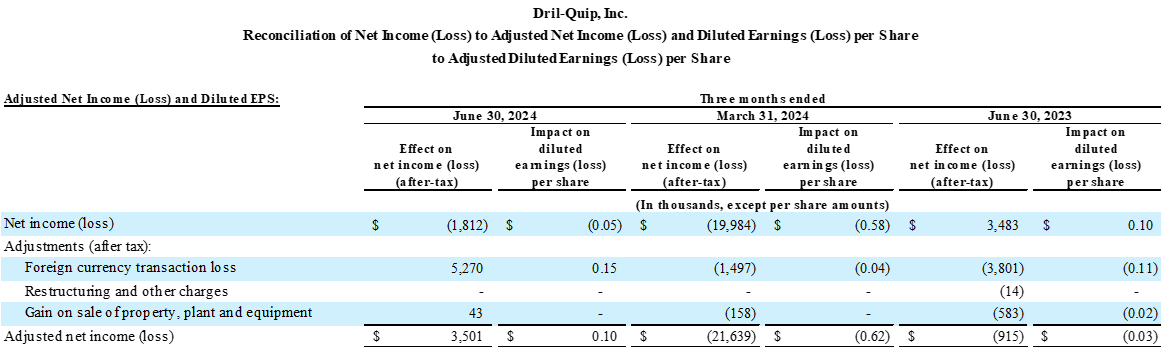

Non-GAAP Financial Information

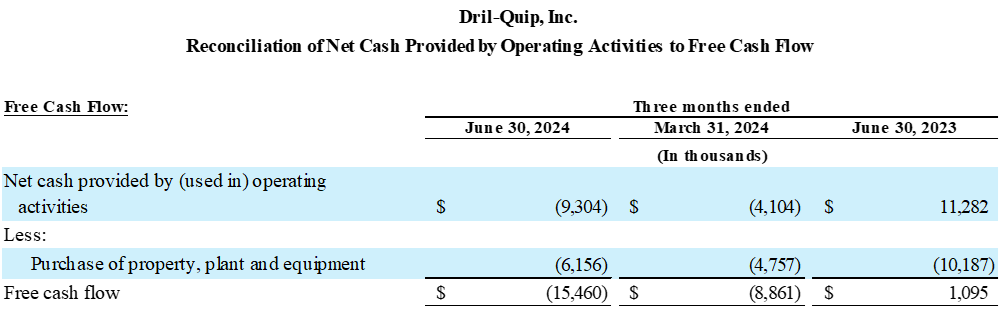

Free Cash Flow and Adjusted EBITDA are non-GAAP measures.

Free Cash Flow is defined as net cash provided by operating activities less cash used in the purchase of property, plant and equipment.

Adjusted EBITDA is defined as net income (loss) excluding income taxes, interest income and expense, depreciation and amortization expense, stock-based compensation, non-cash gains or losses from foreign currency exchange rate changes as well as other significant non-cash items and other adjustments for certain charges and credits.

The Company believes that these non-GAAP measures enable it to evaluate and compare more effectively the results of our operations period over period and identify operating trends by removing the effect of its capital structure from its operating structure. In addition, the Company believes that these measures are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance, ability to pursue and service possible debt opportunities and make future capital expenditures. Free Cash Flow and Adjusted EBITDA do not represent funds available for our discretionary use and are not intended to represent or to be used as a substitute for net income (loss) or net cash provided by operating activities, as measured under

See "Unaudited Non-GAAP Financial Measures" below for additional information concerning non-GAAP financial information, including a reconciliation of the non-GAAP financial information presented in this press release to the most directly comparable financial information presented in accordance with GAAP. Non-GAAP financial information supplements and should be read together with, and is not an alternative or substitute for, the Company's financial results reported in accordance with GAAP. Because non-GAAP financial information is not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures.

Investor Relations Contact

Erin_Fazio@dril-quip.com

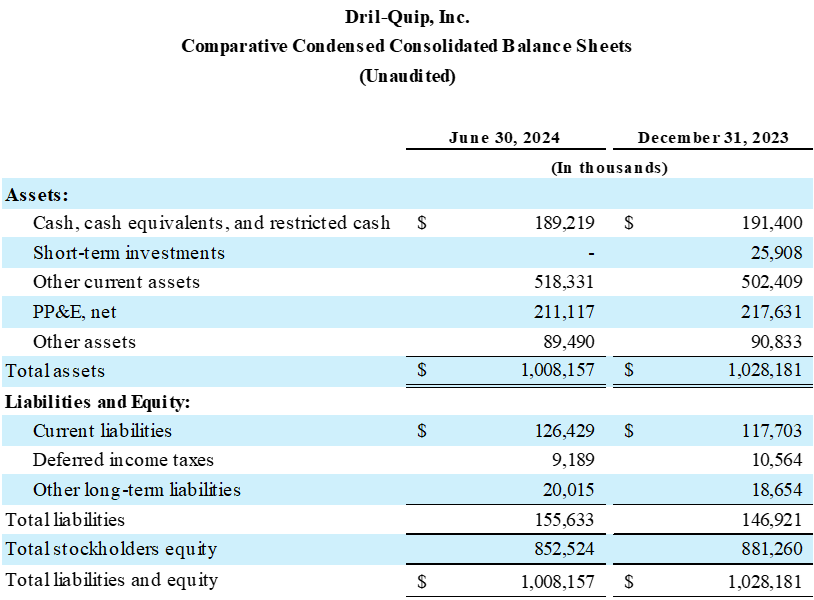

Comparative Condensed Consolidated Income Statement

(Unaudited)

|

|

|

Three months ended |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

(In thousands, except per share data) |

|

|||||||||

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|||

|

Products

|

|

$ |

74,330 |

|

|

$ |

64,562 |

|

|

$ |

55,828 |

|

|

Services

|

|

|

32,714 |

|

|

|

30,187 |

|

|

|

23,733 |

|

|

Leasing

|

|

|

13,298 |

|

|

|

15,548 |

|

|

|

10,046 |

|

|

Total revenues

|

|

|

120,342 |

|

|

|

110,297 |

|

|

|

89,607 |

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

83,229 |

|

|

|

78,419 |

|

|

|

65,711 |

|

|

Selling, general and administrative

|

|

|

29,771 |

|

|

|

29,991 |

|

|

|

22,114 |

|

|

Engineering and product development

|

|

|

3,588 |

|

|

|

3,738 |

|

|

|

3,202 |

|

|

Restructuring and other charges

|

|

|

- |

|

|

|

- |

|

|

|

(610 |

) |

|

Gain on sale of property, plant and equipment

|

|

|

54 |

|

|

|

(200 |

) |

|

|

(738 |

) |

|

Acquisition costs

|

|

|

1,695 |

|

|

|

19,046 |

|

|

|

1,134 |

|

|

Change in fair value of earn-out liability

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Foreign currency transaction loss (gain)

|

|

|

6,671 |

|

|

|

(1,895 |

) |

|

|

(4,812 |

) |

|

Total costs and expenses

|

|

|

125,008 |

|

|

|

129,099 |

|

|

|

86,001 |

|

|

Operating income (loss)

|

|

|

(4,666 |

) |

|

|

(18,802 |

) |

|

|

3,606 |

|

|

Interest income, net

|

|

|

(2,053 |

) |

|

|

(2,196 |

) |

|

|

(1,979 |

) |

|

Income tax provision (benefit)

|

|

|

(801 |

) |

|

|

3,378 |

|

|

|

2,102 |

|

|

Net income (loss)

|

|

$ |

(1,812 |

) |

|

$ |

(19,984 |

) |

|

$ |

3,483 |

|

|

Net income (loss) per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.05 |

) |

|

$ |

(0.58 |

) |

|

$ |

0.10 |

|

|

Diluted

|

|

$ |

(0.05 |

) |

|

$ |

(0.58 |

) |

|

$ |

0.10 |

|

|

Depreciation and amortization

|

|

$ |

8,007 |

|

|

$ |

8,432 |

|

|

$ |

7,049 |

|

|

Capital expenditures

|

|

$ |

6,156 |

|

|

$ |

4,757 |

|

|

$ |

10,187 |

|

|

Weighted Average Shares Outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

34,437 |

|

|

|

34,417 |

|

|

|

34,130 |

|

|

Diluted

|

|

|

34,437 |

|

|

|

34,417 |

|

|

|

34,490 |

|

press releaseaccesswire.com